Banking has become something that you do instead of requiring one to visit a place. Some are even going beyond traditional services to include financial services that are empowering clients. The Capitec banking app is amongst some that are enabling powerful financial services such as enabling clients to buy shares directly from the app.

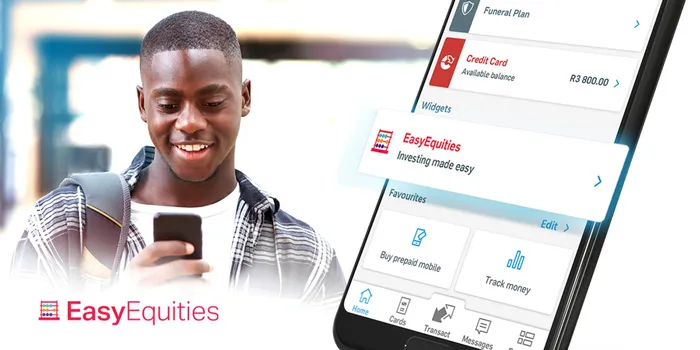

Capitec, South Africa’s largest digital bank, has added the EasyEquities investing platform to its new banking app, allowing its clients to invest in shares on stock markets in South Africa and the USA.

Getting equities used to be a privilege reserved for the elites. The partnership between Capitec and EasyEquities is enabling ordinary people to now buy shares in listed companies.

“The partnership brings our clients greater accessibility to a variety of investment options, in an affordable and simplified way. We currently have over 4 million app clients, who will now not only be able to invest in top South African companies but also those based in the USA, a unique feature not offered by traditional brokers,” says Francois Viviers, Executive of Marketing and Communications at Capitec.

EasyEquities is an online platform that allows anyone to buy shares with as little as R5, $10, or whatever amount they have available to invest (and with no monthly brokerage fees).

Charles Savage, CEO of EasyEquities explained this unique ability, “EasyEquities is a qualified intermediary with the IRS, which simplifies opening a US investment account and lowers the cost of trading US shares. Our EasyFX feature allows Rands to be converted to Dollars within the platform and then used for the purchase of US shares.”

Clients also enjoy a 20% discount on brokerage fees when using the new widget and pay zero data costs when accessing the widget, as Capitec’s app is zero-rated for data.

“EasyEquities have made investing accessible to all, through affordable fees, removing the need for minimum investment balances and using digital technology to create a simplified client experience. Their approach is based upon the same principles we have used to challenge the norms of traditional banking, making our partnership with them a perfect fit,” Viviers says.

Savage, expressed excitement at the opportunities the partnership would create for South Africans, “This partnership is the realisation of a dream for all of us at EasyEquities. To be able to work alongside the Capitec team has been a privilege and we are incredibly excited about what the two teams can do together in making investing simpler for all South Africans.”

South Africa's Gross Savings Rate* is low, measured at just 15.4 % in March 2020 according to CEIC, and it’s a national imperative to encourage South Africans to invest and save as much of their income as possible.

“By giving South Africans easy access to investing we can help shift investment behaviour in the right direction. EasyEquities is perfect for first-time investors as it offers a demo account, which can be used to familiarise yourself with the markets you are interested in, before investing actual money.” Viviers added.

Capitec clients are able to access EasyEquities from the latest version of their banking app by clicking the “explore” tab and then navigating to “widgets”. “Existing EasyEquities clients can easily sign-in and link their accounts. New clients can follow the registration process and then start investing,” Viviers said.

What Capitec and Easy Equities are enabling their clients to do is changing the face of the banking and financial services sector for the better. Accessibility to financial services has never been this easy. Now more than ever before South Africans can get a slice of listed companies with a touch of a button on their mobile phones.